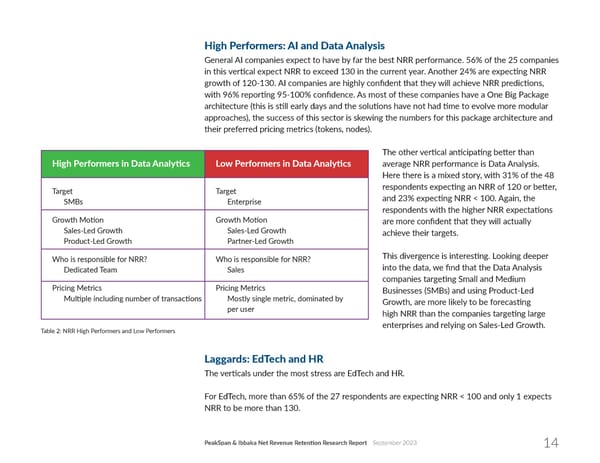

High Performers: AI and Data Analysis General AI companies expect to have by far the best NRR performance. 56% of the 25 companies in this ver琀椀cal expect NRR to exceed 130 in the current year. Another 24% are expec琀椀ng NRR growth of 120-130. AI companies are highly con昀椀dent that they will achieve NRR predic琀椀ons, with 96% repor琀椀ng 95-100% con昀椀dence. As most of these companies have a One Big Package architecture (this is s琀椀ll early days and the solu琀椀ons have not had 琀椀me to evolve more modular approaches), the success of this sector is skewing the numbers for this package architecture and their preferred pricing metrics (tokens, nodes). The other ver琀椀cal an琀椀cipa琀椀ng be琀琀er than average NRR performance is Data Analysis. Here there is a mixed story, with 31% of the 48 respondents expec琀椀ng an NRR of 120 or be琀琀er, and 23% expec琀椀ng NRR < 100. Again, the respondents with the higher NRR expecta琀椀ons are more con昀椀dent that they will actually achieve their targets. This divergence is interes琀椀ng. Looking deeper into the data, we 昀椀nd that the Data Analysis companies targe琀椀ng Small and Medium Businesses (SMBs) and using Product-Led Growth, are more likely to be forecas琀椀ng high NRR than the companies targe琀椀ng large enterprises and relying on Sales-Led Growth. Table 2: NRR High Performers and Low Performers Laggards: EdTech and HR The ver琀椀cals under the most stress are EdTech and HR. For EdTech, more than 65% of the 27 respondents are expec琀椀ng NRR < 100 and only 1 expects NRR to be more than 130. PeakSpan & Ibbaka Net Revenue Reten琀椀on Research Report September 2023 14

Net Revenue Retention Page 13 Page 15

Net Revenue Retention Page 13 Page 15